Critics denounce a BPA draft decision to leave the Western energy market, possibly threatening renewables growth at home

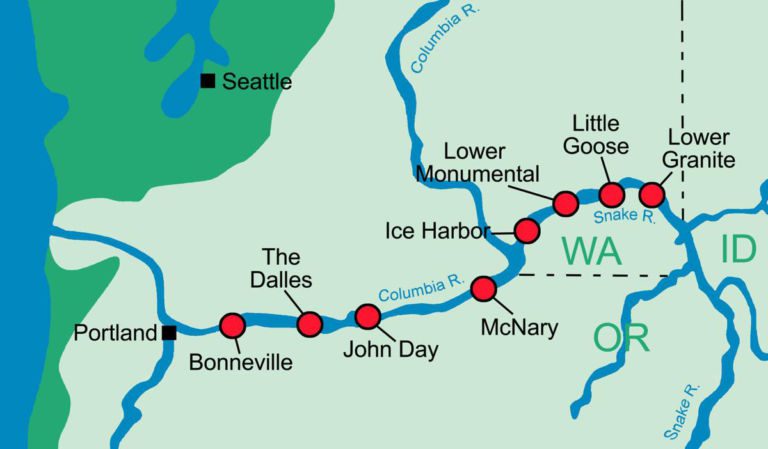

Market shift: The Bonneville Power Administration is turning its back on California and sending itd power elsewhere. Image: BPA

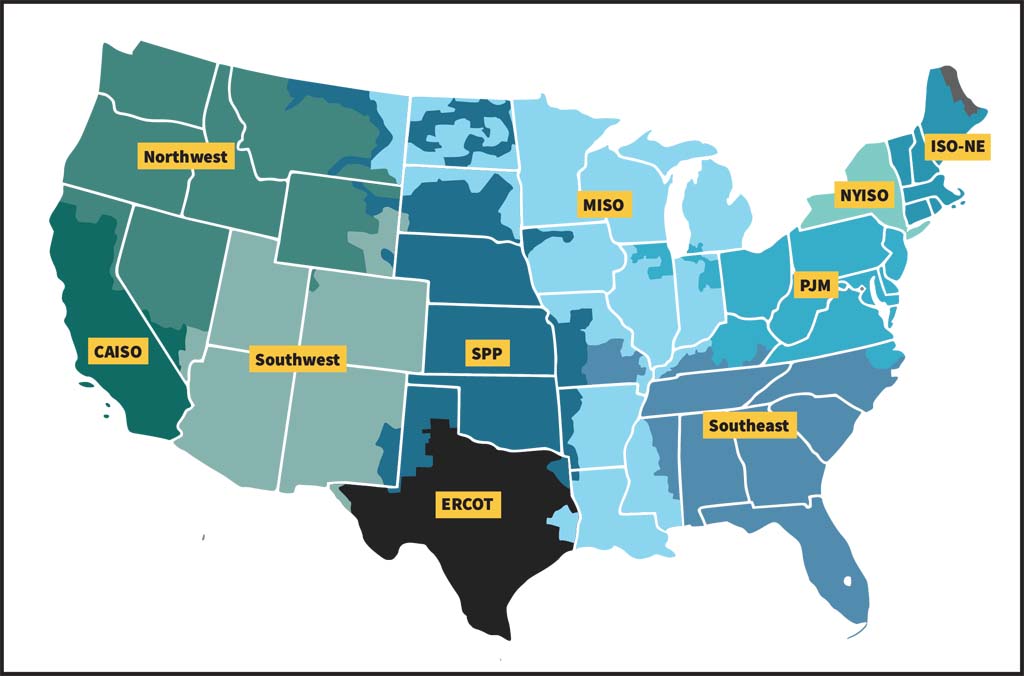

By Kendra Chamberlain. March 13, 2025. The Bonneville Power Administration (BPA) announced last week that it intends to join a new electricity trading market rather than participate in a similar market being developed by California’s electricity market CAISO.

The news has resulted in cheers from public utilities and outcry from consumer advocates.

It also raises concerns about the continued growth of renewable energy sources in the Columbia River Basin.

Utilities across the West are considering how to move toward day-ahead markets, which operate in conjunction with real-time markets and allow utilities to lock in electricity prices in advance.

CAISO began developing its Extended Day Ahead Market (EDAM) in 2019. In 2022, the Arkansas-based Southwest Power Pool (SPP) began work on its own day-ahead market, called Markets+. SPP operates grids in all or parts of Arkansas, Iowa, Kansas, Louisiana, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Oklahoma, South Dakota, Texas and Wyoming.

UPDATE: On March 18, 2025, the BPA adds: “While based in Arkansas, SPP is standing up a newly designed market specifically for the western part of the U.S. This western market is not intended to transact with SPP’s already existing and operating eastern markets.”

The BPA says it has evaluated opportunities to join a day-ahead market, and then looked at which market would be the most advantageous to join.

In its draft decision, BPA—which participated in the development of both day-ahead markets—emphasized that the SPP’s Markets+ would offer an independent governance mode that BPA staff believes will help it realize more long-term benefits than CAISO’s EDAM.

“Bonneville concluded that joining a day-ahead market is in the best interest of the agency and its customers from an economic perspective,” wrote in its Day-Ahead Market Draft Policy paper.

Many of the utilities served by BPA are on board with the decision.

“BPA’s decision to move forward with Markets+ underscores the strength of the SPP Markets+ option which was designed by diverse stakeholders across the West,” Scott Simms, CEO and executive director of the Public Power Council (PPC), said in a statement. The Public Power Council is an industry group representing consumer-owned utilities in the Pacific Northwest that purchase power from BPA.

The BPA will still be legally obligated to supply power to the 140 consumer-owned utilities in the region first, and will continue to sell its excess power to other utilities in the Pacific Northwest.

Environmental implications

Some of the larger power companies in the region, like PacifiCorp and PGE, have said they’ll stick with CAISO’s EDAM for now. Other companies may follow BPA’s lead and move to Markets+.

The Northwest Energy Coalition (NWEC), a group of 100 environmental and civic organizations, utilities and businesses across the Pacific Northwest, says that many studies—including one commissioned by BPA itself—show the decision will lead to increased costs, less reliability and more difficulty in adding renewable energy sources to the grid.

NWEC senior policy associate Fred Heutte told Columbia Insight that the decision to join SPP’s day-ahead market is confusing.

The move would result in two markets operating atop the same grid in the Pacific Northwest, and would reduce diversity of power sources in each market.

There’s also limited transmission between the Northwest and SPP’s other participating grids.

U.S. electric power markets: Traditional wholesale electricity markets exist primarily in the Southeast, Southwest and Northwest. Federal systems include the Tennessee Valley Authority, Western Area Power Administration and the Portland-based Bonneville Power Administration. Map: FERC

The emergence of two markets in the region could have big implications for renewable energy integration in the Pacific Northwest.

It could complicate coordinating renewable energy development and new transmission projects within the region, said Heutte, and will create “seams” between the two markets that will generate new costs related to managing power flows and coordinating transmission at the boundaries of two organized markets.

It could also impact efforts to remove the Lower Snake River dams in support of salmon recovery in the river.

A major settlement agreement 22 years in the making and released in 2024, calls for up to $1 billion in investments along the Lower Snake River over the next decade for salmon recovery and renewable energy build-outs to facilitate the removal of four dams along the river. The agreement is between the Confederated Tribes and Bands of the Yakama Nation, Confederated Tribes of the Umatilla Indian Reservation, Confederated Tribes of the Warm Springs Reservation of Oregon and the Nez Perce Tribe, along with the states of Oregon and Washington and several nonprofits.

The proposal to remove the four dams hinges on replacing the power those dams generate with renewables.

“A single market would make it easier to develop and transmit replacement renewable energy—much of which can be developed in the area around those dams and use existing transmission,” said Heutte.

The four dams on the Lower Snake River are “run of the river” dams, meaning they don’t offer much storage of water and so can generate power based only on what’s coming down the river.

The dams produce the most power during the spring run-off season—at a time when hydropower in the region is at a surplus—and produce much less power during other parts of the year.

“A balanced, clean-energy replacement portfolio for the Lower Snake River dams will have a better fit to seasonal power demand in the Northwest, especially in mid-winter and late summer when flows in the Snake River are low,” said Heutte.

Who will pay more?

Not everyone is convinced the move will benefit consumers.

“Every power customer in the Northwest is at risk for higher costs on their monthly bills,” NWEC said in a statement.

“Bonneville’s own commissioned study by E3 shows that the likely outcome of being in Markets+ would be plus or minus around $100 million a year of net losses compared to where they are now in the Western Energy and Imbalance Market,” said Heutte. “Just on the cost side, this doesn’t make much sense at all. Why would an agency do this, even though their own study says it’ll [lose money]?”

BPA has admitted its analyses show joining EDAM would offer financial benefits to BPA and its customers.

But BPA’s Rachel Dibble told reporters during a press briefing that it sees SPP’s governance model of the day-ahead market as a key benefit.

“We have really significant beliefs about the importance of governance, the importance of an open stakeholder process, and while those cannot be quantified, those are qualitative elements that we hold as very high priorities, and we do believe in the long run, they will result in positive quantitative benefits,” Dibble said, according to Utility Dive.

BPA has long been critical of CAISO’s decision-making. The system is governed by a board appointed by the Governor of California, and is beholden to California’s state laws, and its ratepayers, a fact that BPA staff believes have left BPA in a less than ideal position as a participant.

BPA said in its draft decision that it still felt it was playing second fiddle to California interests during the development of EDAM.

NWEC’s Heutte isn’t buying that argument.

There’s already an initiative underway to address CAISO’s governance, he said. The Pathway Initiative, which aims to increase transparency and include more stakeholders in governance decisions “sets up a new governance structure that’s better than what anybody has right now,” Heutte said.

“Let’s get real here. What is motivating this? This is the big question. Why?” Heutte said. “We don’t really know.”